Why bother investing in Japanese small capitalized companies?

Since late summer of 2021, I have published blogs on Japanese small cap stocks. Now at the beginning of the new year, I would like to explain what prompted me to take up on this seemingly hopeless projects.

My motive to write blogs in introducing Japanese small companies to global individual investors is PERSONAL. I want to help my motherland in my small ways.

For non-Japanese individual investors, Japanese stocks don’t have much of mind share. Nobody can blame you. Japanese stocks had poor performances in 2021: Nikkei went up by a meager 1.8% when Dow and S&P 500 appreciated 19% and 27% respectively. The performance of Mothers section where many startups are traded is miserable with negative 21% vs. Nasdaq’s 21% ascent.

However, I still think that Japanese stocks (large or small) have some positions in your alpha-seeking portfolio. Why?

1. Higher interest rates’ impacts

As US stocks are expected to go though some turbulence, thanks to Fed’s tightening stance (i.e., less liquidity in the markets), global investors may start to look for undervalued markets. Since Japan tends to follow US markets with 2-3 years of time lag, Japanese market may offer good alternative alpha opportunities.

It is true that rising interest rates will have larger negative impacts on growth companies which has long term horizon.

2. Cheaper Valuations.

Some of you may think that Japan is cheap for a reason. Yes, I have heard the phrase “Japan’s lost three decades”. However, current large valuation gaps: Topix PE is 14x vs. S&P 500’s 22x may be discounting Japanese woes too severely. Japan’s PE is lower than its own 15-year average of 16x.

As an example, let’s take a look at NYK Lines (Nippon Yusen). It is Japan’s largest sea-based transportation company which has benefited from global supply constraints. Still, It is trading at single digit PE of 2.2x, while its expected sales growth for FYE 3/22 is 24.4%. Its net income is forecast to quadruple to JPY 710Bn. Current strong shipping demand may come down from 2021’s high level in 2022, but PE of 2.2x appears to have amply discounted the decrease.

3. Growth potential is REAL

There are many companies with solid sales growth estimates but went through severe selling pressure in 2021. For example, sales of Kokopelli (Ticker: 4167)* is expected to grow 76% in FYE 3/22 and 38.9% in FYE 3/23. Despite this strong top line growth guidance, the stock lost 72% of its value in 2021. Large volume of margin sell volume is one of culprits but negative sentiments likely plays a role in the stock’s sharp decline.

It is true that the aforementioned rise in interest rates will larger negative impacts on growth stocks such as Kokopelli. However, the company keeps turning in solid sales numbers, the stock should start to recover.

*Kokopelli offers Japanese SME (small to midsize entities) and regional banks business outsourcing services. It mainly provides payroll computation and bookkeeping services. It can also handle AI based credit risk analysis.

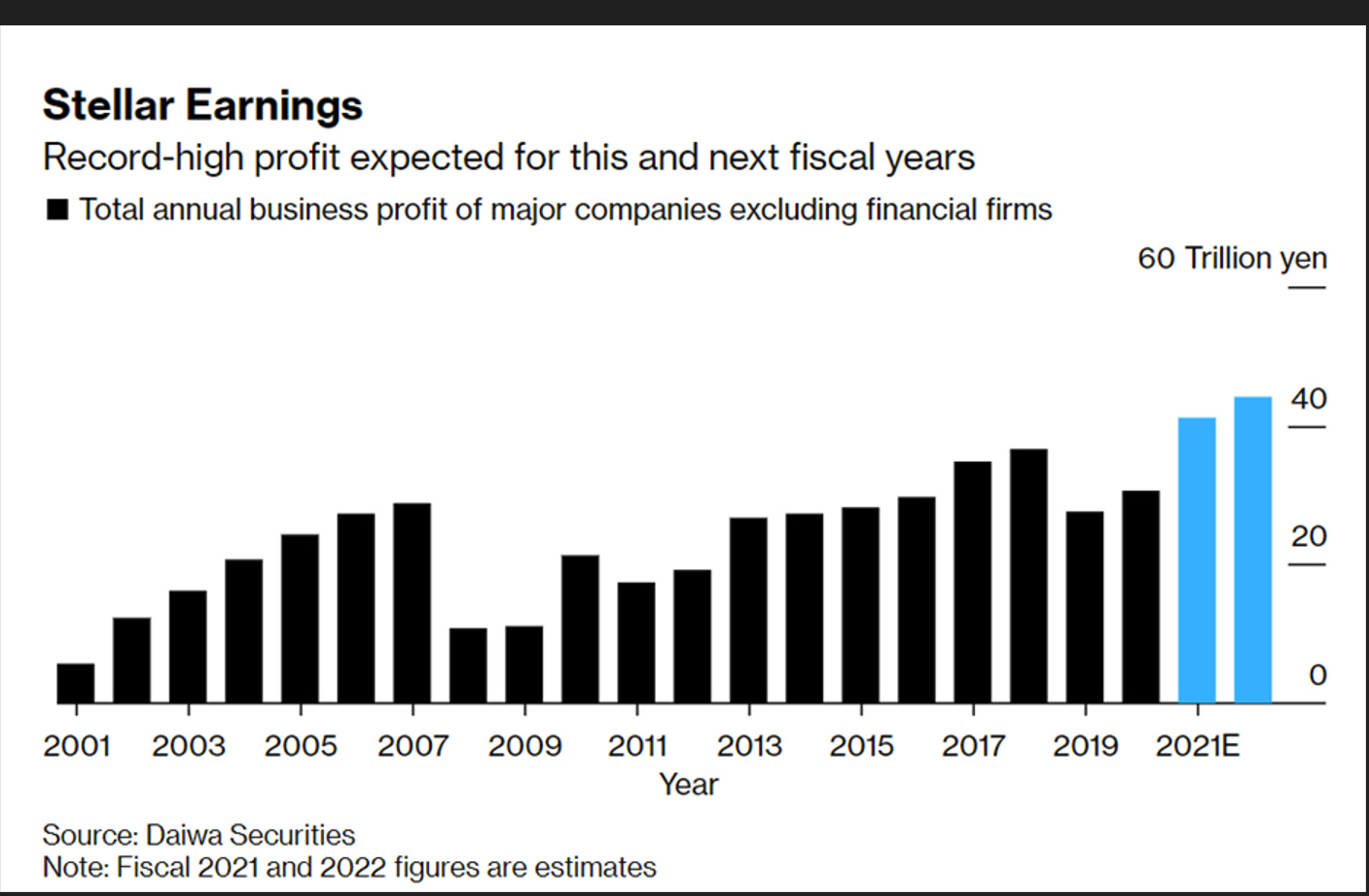

The below is major Japanese companies’ expected earnings for FYE 3/22 and FYE 3/23.

(Source: Bloomberg article which cites Daiwa’s chart as of 12/16/21)

4. Politics

Prime Minister Kishida has recently announced JPY 56 Tn fiscal stimulus which is likely start filtering into the economy in 2022.

5. Japan’s core issues

I do realize that what foreign investors truly want are policies which address the core issues of shrinking population and low productivity as a result of slow adoption of technology. These issues take time to get resolved. I, for one, believe that there are rising numbers of new start ups which are tackling these problems head on.

It is my goal to keep introducing you these companies.

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance